Have you been reading Susana’s daily newsletter about the AI infrastructure market? You should; it’s a good read. Today, she leads with a story about a big new US data center. It is a massive one, in fact, at 7.65 GW, which is as big as data centers (and pollution permits) are allowed to get – in a part of the US where bigger is always better, and which likes to tell you so: Texas, which has emerged as a global data-center HQ. The first phase is scheduled for the first half of 2027, with 1 GW to go online in 2028; the rest (over 5 GW, at least) will be completed by 2031, she writes. It will consume as much coal-fired power as a not-insignificant percentage of an even bigger country than the US: about five percent of Canada’s dirty power. Susana and the team will be following with interest, of course.

Elsewhere, and linked below, Susana has a story about how AI promises are outrunning AI realities – for enterprises, and therefore for consumers. Time to get real with all this expensive AI innovation and spadework, she says; time for the AI proofs to pay off in commercial benefits. Because consumer sentiment about power usage and power prices, air pollution and noise pollution, and massive layoffs across the global economy is starting to tell. “AI requires a flip-flop in the energy mix,” she writes. Data centers account for 14% of total energy used in the US; the share needs to go higher than 50% to expand AI, she says. It will take trillions of dollars of investments, and the public will not just sit around while their power bills spiral – unless there is proper payback.

For more from Susana and the team on AI infrastructure, sign up to the newsletter here.

James Blackmann

Executive Editor

RCR Wireless News

RCR Top Stories

AI cap-ex tensions: Real AI proofs and benefits are needed to allay consumer, employee, and policymaker concerns about AI infrastructure – cap-ex tensions are mounting as the physical demands of data centers collide with digital expectations.

NTT + AWS 4 B2B AI: NTT Data and AWS have a new multi-year deal to drive enterprise cloud modernization, scale agentic AI adoption, and deliver industry-specific and sovereign cloud solutions across regulated markets.

Telia flat in 2025: Telia delivered stable revenue and higher cash flow in 2025 despite lower net income, while reaffirming its 2026 outlook, proposing a higher dividend, and announcing plans to reduce staff as part of cost discipline.

Telcos fail to disrupt: Cloud-native networking promises agility, but telcos face cultural, legacy, and vendor challenges. Telefónica Germany’s CTIO explains why disruption – not technology – is the industry’s biggest barrier to transformation.

Tech sovereignty: Tech sovereignty is complex, says Joe Madden at Mobile Experts says. Truly sovereign control over cloud, AI, networks, and satellites is feasible only for large powers like the US and China, he argues.

AI-Powered Telecom Infrastructure

Supermicro, in collaboration with NVIDIA, delivers AI-powered infrastructure tailored for telcos, enhancing operational efficiency, network management, and customer experiences. Explore now

Beyond the Headlines

Tecto Brazil facility: Brazilian company Tecto has announced plans for a $38-million 20-MW data center in Porto Alegre, with initial capacity due in late 2026 and direct connectivity to V.tal’s Malbec submarine cable.

AI lifts T&M boats: Advantest capped off a great quarter, buoyed by AI. At the earnings call, the company outlined plans to ramp up capacity as orders for chip and memory testers continue to surge amid breakneck AI infrastructure buildout.

Nokia steady-ish: Nokia saw net sales rise a little in 2025, even as margins slipped with investments and restructuring. Seems there is good sense in its big-ticket network infrastructure strategy, perhaps, but some decisions still look screwy.

Turn it down, Amazon! Researchers at the International Astronomical Union have found that Amazon Leo satellites orbiting at 630 km exceed accepted brightness limits, raising concerns about interference with astronomical observations.

5G-A monetization: With the consumer smartphone market saturated, telcos must pivot. From speed-based tariffs to network APIs, discover four ways 5G‑Advanced unlocks new consumer monetization beyond FWA.

What We're Reading

Data centres doubling: Global data center revenue will grow from $430 billion in 2026 to over $1.1 trillion by 2035, with double-digit CAGR. Growth spans hyperscale, colocation and edge infrastructure worldwide.

AI has to earn trust: Canadians and Americans want companies to earn their trust in AI adoption, according to TELUS’ cross‑border AI study, with strong calls for review of AI harms, clear explanations, customer input, and robust regulation.

NTT APIs on Aduna: NTT DOCOMO is to make its network APIs available on Aduna’s global platform, aiming to expand access to secure, standardized mobile network services worldwide and accelerate enterprise integration and innovation.

Malaysian subsea grid: LS Cable & System won a KRW 60 billion contract from Malaysia’s Tenaga Nasional to build a 132 kV submarine power grid connecting Langkawi, strengthening its position in the Asia-Pacific submarine cable market.

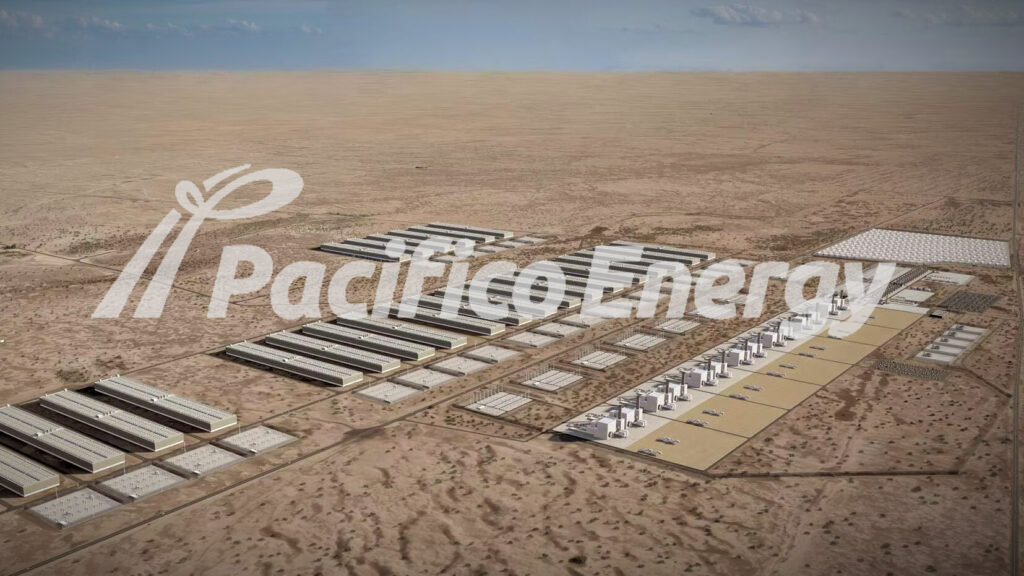

Altman eyes green AI: Sam Altman-backed renewable energy developer Exowatt has launched a business arm to provide powered land and proprietary solar infrastructure to support hyperscale and AI data centers.

Events

Join this RCR Wireless News‘ event to understand the current state of the Wi-Fi as we examine a myriad of evolving use cases and monetization strategies being deployed by industry. Register now

Industry Resources

Webinar, September 18th

The journey to a fully autonomous network – The evolution of network automation and how Amdocs is leading the way