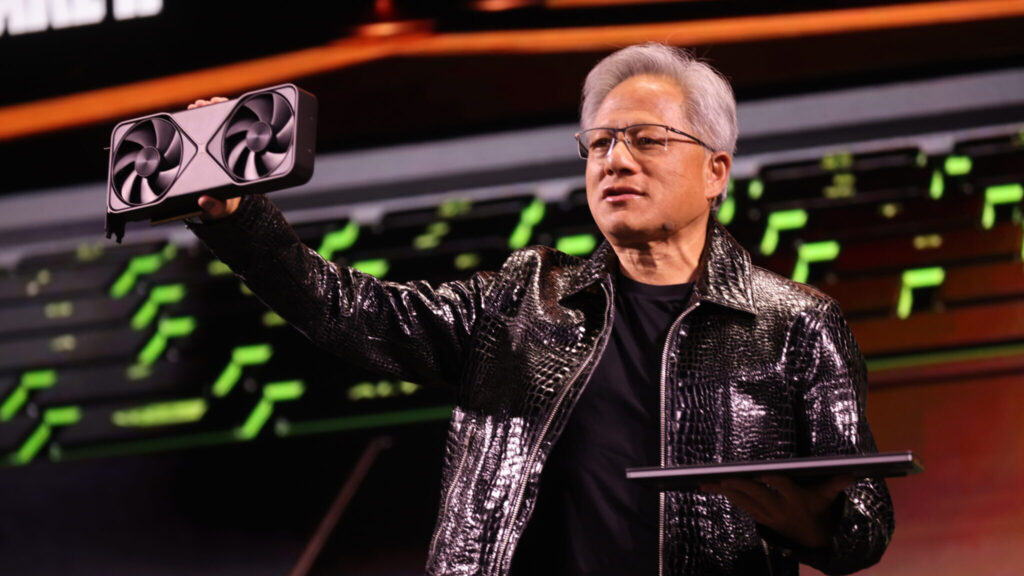

What to make of the news from Nvidia at CES? Because everyone will make something of it, right – this being the world’s most valuable company, and its ghastly-jacketed owner-boss, Jenson Huang, being the big-tech oracle for the whole global economy. Well, given my (historical) beat at RCR, I have a particular view: that it is all about the difficult Industry 4.0 market (even if Nvidia avoids the label), and that Nvidia is late to the game; but also that the Santa Clara firm’s strategic tardiness and teflon magnetism will either drive new interest in Industry 4.0, or kill it for big tech once and for all.

A quick recap, from yesterday in Vegas: Nvidia made it clear at CES where it sees the future – in enterprise AI, industrial robotics, and physical intelligence. Plus driverless cars, as a sexier articulation of the same. But this is all Industry 4.0 stuff, as much about IoT sensing as it is about AI sense-making. In Vegas, Huang showcased Rubin, a six‑chip rack-scale AI platform, alongside frameworks for autonomous systems, edge intelligence, and industrial deployments. These ‘things’, a way-away from the firm’s traditional heartlands in consumer GPUs and gaming (maybe why its stock barely budged after the keynote), have been in development for years.

Which is not to say Nvidia has not been dropping this stuff into its roadmap already; nor that the whole mega-bucks bricks-and-mortar AI build-out, to house its AI-geared GPUs, has not (really) been in service of incoming enterprise workloads. But at CES, this was the story for Nvidia, even if it was translated in the popular press as AI for cars and taxis (foregrounding its chain-of-thought Alpamayo portfolio and work with Mercedes-Benz). But physical AI, as promoted by automation vendors for ages, and as presented by Huang on Monday, is about robotics to drive physical automation and industrial control.

And the ones in proper need of such pyrotechnics are industrial enterprises, busy rolling out their own private AI data centres and data networks. Which presents an interesting dynamic – the darling of the tech world at the sharp end of Industry 4.0, which big tech has been quitting the Industry 4.0 scene in droves over the last 12 months. Because it’s too much like hard work. Because it requires systems integration. Because it is a team sport and speculative pursuit, and not a big-box sale to big-ticket customers. They miss the point, and will miss the boat. Contrary to big-vendor balance sheets, industrial AI and automation are progressing steadily.

Predictive maintenance, robotics systems, edge applications are delivering measurable ROI in just about every hard-nosed industrial sector, and will eventually jump with higher-grade AI reasoning. It will take time, but it sounds like Nvidia also knows it’s where AI will pay.

James Blackman

Editor

RCR Wireless News

RCR Top Stories

MediaTek intros Wi-Fi 8: MediaTek’s Wi-Fi 8 demonstrations at CES 2026 reflect a growing demand for more reliable wireless connectivity as AI-driven and latency-sensitive applications expand.

Singtel’s 50Gbps fiber… Singtel has launched Singapore’s first 50Gbps fiber broadband trial, testing next-generation connectivity designed to support AI-driven homes, immersive media, cloud gaming, and future digital lifestyles.

… and why it matters: Singtel’s 50Gbps XGS‑PON fiber trial highlights a broader industry shift, where both fiber access and core infrastructure are being redesigned to handle next-generation AI bandwidth demands.

DCs to double by 2030: Global data center capacity could nearly double by 2030 as AI demand accelerates, with JLL projecting a $3 trillion investment cycle shaped by power constraints, grid delays, and strong pre-leasing levels.

GSMA on NaaS: Henry Calvert, head of network at the GSMA, joins RCR on the latest episode of Unmuted to discuss what’s driving adoption of Network-as-a-Service – and what’s holding it back.

AI-Powered Telecom Infrastructure

Supermicro, in collaboration with NVIDIA, delivers AI-powered infrastructure tailored for telcos, enhancing operational efficiency, network management, and customer experiences. Explore now

Beyond the Headlines

India expands 5G: India added more than 4,000 new 5G base stations in December, led by Uttar Pradesh and Maharashtra, as BSNL prepares major 4G rollouts and gradual upgrades to 5G nationwide.

Window-mounted 5G: A new partnership between Solace Power and NetComm is aimed at solving FWA’s biggest residential challenges: installation complexity and signal interference. Jeff Kagan explains.

Fiber backbone for AI DCs: AI pressure points are no longer just compute-heavy; they are connectivity-heavy – density, latency, and real-time data movement are now the make-or-break variables in modern data center design.

EXA buys Aqua: EXA Infrastructure has completed its long-running deal for subsea provider Aqua Comms for a knockdown price. The deal strengthens its transatlantic and intra-European routes.

Softbank’s big AI play: The Japanese firm’s $4bn acquisition of DigitalBridge aligns with SoftBank’s long-term ambition to support artificial super intelligence by securing the infrastructure required to train and operate AI models globally

What We're Reading

Nvidia CES round-up: A handy summary of Nvidia’s pronouncements at CES, including presentation of its new Rubin AI platform and open AI model ecosystems, plus AI tools for robotics, edge intelligence, and broader enterprise AI use cases.

AMD chip line-up: AMD used its CES keynote to show its full MI400 accelerator lineup for data-center AI workloads and preview its new MI500 series – which it claims could deliver up to 1,000-times greater AI performance than the MI300X.

Amdocs buys Matrixx: Amdocs is to buy charging vendor Matrixx Software for about $200m, folding it into its OSS/BSS portfolio as part of ongoing industry consolidation. Matrixx had faced financial pressures, making the sale appealing.

New FCC chief economist: FCC chairman Brendan Carr has named Jonathan Williams as new chief economist, leading the office of economics and analytics. He joins from UNC-Chapel Hill, where he was an economics professor.

New 430Tbps record: A research team has set a new record of 430Tbps over standard telco optical fiber, using a technique that boosts capacity without new fibre or wider spectrum, showing existing networks can be significantly enhanced.

Events

Join this RCR Wireless News‘ event to understand the current state of the Wi-Fi as we examine a myriad of evolving use cases and monetization strategies being deployed by industry. Register now

Industry Resources

Webinar, September 18th

The journey to a fully autonomous network – The evolution of network automation and how Amdocs is leading the way